Home Loan Lender for Beginners

Table of ContentsWhat Does Clark Finance Group Mean?Mortgage Broker for DummiesThe Basic Principles Of Home Loan Lender The 6-Minute Rule for Clark Finance Group Mortgage Broker

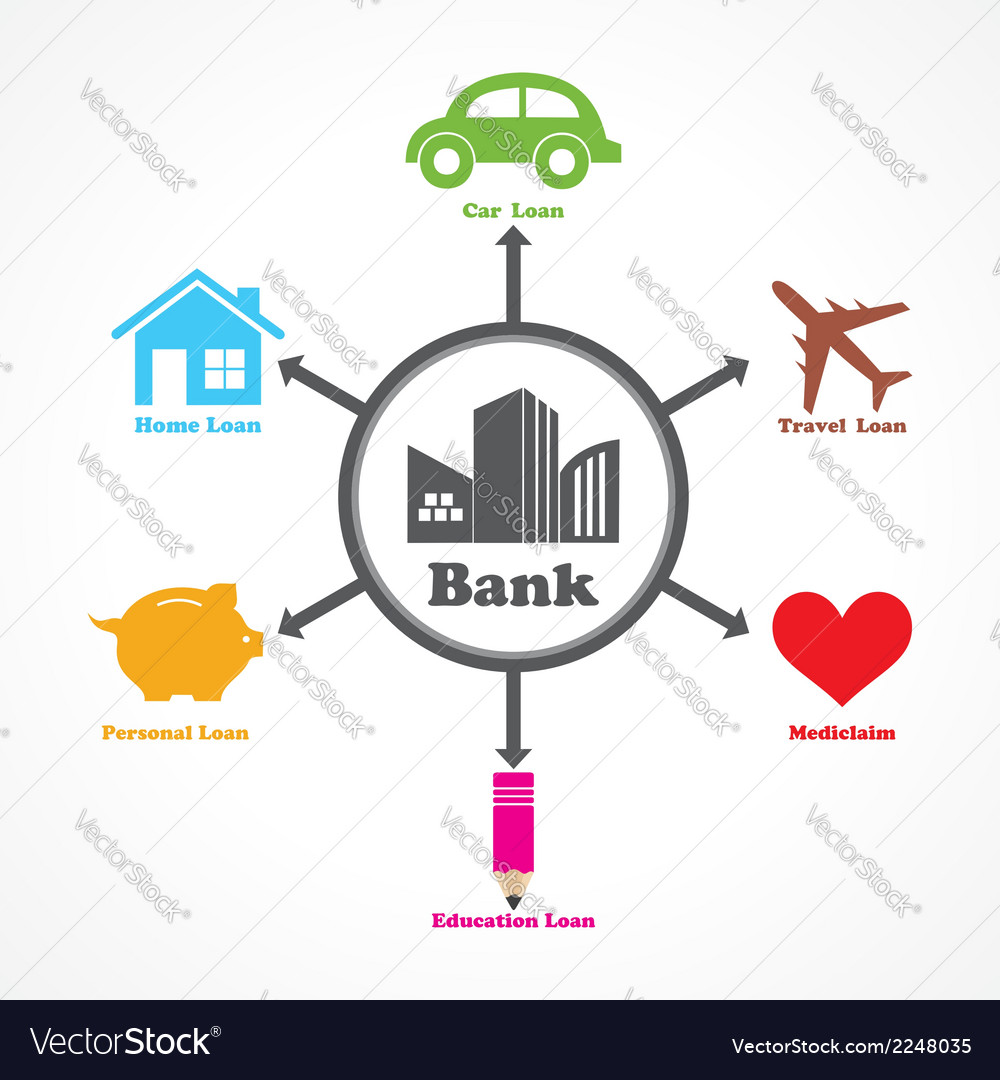

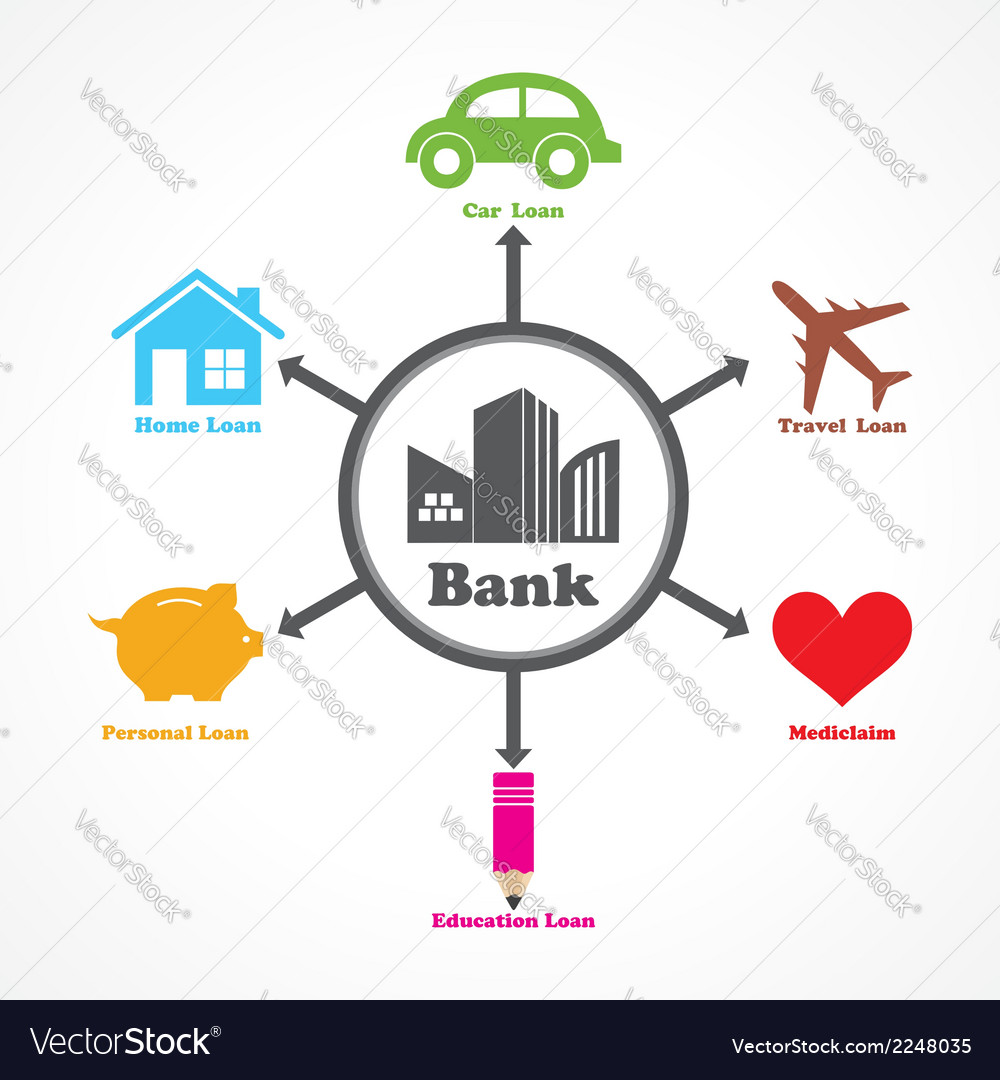

Sorts of Fundings, Personal finances - You can obtain these fundings at virtually any kind of financial institution. The great news is that you can generally spend the cash however you such as. You might take place getaway, buy a jet ski or obtain a new tv. Personal lendings are often unsafe as well as fairly very easy to get if you have ordinary credit rating.These loans are protected by the home or home you are acquiring. That implies if you don't make your settlements in a timely way, the bank or loan provider can take your residence or residential or commercial property back! Home mortgages aid people get involved in residences that would or else take years to conserve for. They are usually structured in 10-, 15- or 30-year terms, and the interest you pay is tax-deductible and relatively reduced contrasted to various other financings.

The equity or funding quantity would certainly be the distinction between the appraised value of your house and also the amount you still owe on your mortgage. These lendings are excellent for house additions, residence improvements or financial obligation loan consolidation. The interest price is frequently tax deductible as well as also rather reduced compared to other lendings.

They do require a little bit even more work than regular as well as frequently call for a company plan to show the legitimacy of what you are doing. These are usually guaranteed financings, so you will certainly need to pledge some individual properties as collateral in case the organization falls short. Advantages of Car loans, Organization growth and also growth - Car loans are a great means for a service to expand as well as grow quicker than it or else could.

6 Simple Techniques For Clark Finance Group Home Loan Lender

Interest - Paying just the interest on Continue multiple lendings can wind up setting you back individuals tens of countless bucks a year. One car loan might be manageable, however include a house financing, 2 auto loan, trainee car loans as well as a few credit card breakthroughs into the mix, and also the rate of interest can obtain out of control extremely rapidly.

You do it a lot of times, as well as the bank or loan provider can legitimately take back your home that you have actually been paying on for 10 years! Lesson Summary, A finance is when you get money from a close friend, bank or financial establishment for future payment of the principal and also interest.

Some Known Details About Clark Finance Group Mortgage Broker

Individual car loans supply you quick, versatile accessibility to funds that can be made use of for numerous major life events, costs or combining financial obligation, all with one taken care of regular monthly repayment. Combine bank card financial obligation Simplify your regular monthly bills by consolidating your high interest financial obligation Restore your residence Update your space without using your home as security Acquisition or fix an automobile Buy the most effective car loan price as well as purchase or fix your car anywhere Take a vacation Money your whole journey or use it for spending money Fund your wedding celebration Spread the price of your special day over months or years Cover clinical costs Cover unforeseen expenses or prepared treatments.

It's usually a percentage of the lending added on top of what you currently owe. 1 As for exactly how much passion you'll pay, there are various interest prices for different kinds of financings.

Up until now, so good. The tricky part of trying to find a finance comes when you begin searching for sorts of consumer loans. You're bound to discover long lists and also complicated terms like "secured" and also "unsafe" (which are not referring to just how you feel today). As you find out go right here about loans, being familiar with my latest blog post essential phrases as well as terms can help you locate the right type for you.

Kinds of little organization finances Traditional or term finances A term car loan, which is additionally described as a conventional finance, is financing borrowed from a financial institution that needs to be paid off over a set period of time. This could be either a brief or extended period, ranging from a couple of months to a number of years.

A Biased View of Clark Finance Group Home Loan Calculator

SBA car loans The Small Business Administration (SBA) funds several finances that are guaranteed by the federal government - Clark Finance Group Home Loan Lender. One of the most common kind of SBA lending is the SBA 7(a) financing. It has a maximum limitation of $5 million and also is typically utilized to acquire realty, in addition to for functioning resources and financial obligation refinancing.

SBA microloans are expanded up to $5,000 with the objective to aid local business grow and also buy their capital, stock, as well as equipment. Tools financing car loans A tools financing funding is one that permits owners to acquire devices and also machinery for their operations. Organizations can make use of a finance towards office devices and also devices for workers or to produce items.

Unlike other finances, organizations will require to make a down repayment prior to obtaining the lending. The most usual type of SBA financing is the SBA 7(a) car loan.